Prices, Conditions and Threats Documented in 2021

Report by Public Works Studio based on a field survey conducted during March - April 2021

Written by (in alphabetical order): Tala Alaeddine, Nadine Bekdache, Jana Haidar, Abir Saksouk

Data Management: Jana Haidar

Mapping: Rayane Alaeddine, Jana Haidar

Field Survey: Rayane Alaeddine, Rita Kamal, Ramy Sabek

Economic Consultation: Joane Chaker

Legal Consultation: Zeina Jaber

Table of Contents

1. Introduction

2. Land as real estate: Practices of the State, Municipality, and Brokers

3. Realtors 'City View' Inflate Rent Prices

4. Reading Rent through Spatial and Symbolic Factors

5. Generating Insecurity

6. Conclusion

1. Introduction

More than half of the population in the main Lebanese cities experience extremely weak housing tenure status; thus constituting the category of tenants constantly at risk of eviction, a condition generated and maintained by the governing legal and urban framework.

The role of the public sector in the provision of housing over the past three decades has been characterized by withdrawal from social responsibility by relegating all housing provision to deregulated private housing markets. As such, Since the 1990s, the only housing policy has been ownership policy through “soft” loans. This has created a context where housing prices are constantly skyrocketing creating a mismatch between supply and demand, displacement caused by real estate speculation, socio-economic inequalities, segregation, spatial fragmentation, and increased difficulties in the access to housing resulting in housing insecurity.

The profitability of the real estate sector has led to mass waves of land purchasing by investors, who are able to - due to weak regulations - alarmingly limit the city’s residential capacity and maintain the real estate profit-making machine. This is mostly played out by demolishing the existing urban fabric, maintaining a high vacancy rate in both new and old buildings, and transforming the existing housing stock into temporary or precarious housing arrangements.

In the absence of housing regulations that protect dwellers’ rights to safe and adequate housing, the economic collapse that Lebanon sunk in, whilst coinciding with COVID-19 state measures, left tenants uncertain about the future of their housing. The scenarios that played out were diverse, depending on a multiplicity of factors concerning the profile of the property owner and the tenant. The elderly, low income tenants, refugees, migrant workers and women are amongst the most vulnerable groups and are often subjected to abuse by their landlords, while possessing limited access to the means enabling them to defend their housing rights, be it legal or other.

The study at hand carves a reading of rental practices in conjunction with a steep currency devaluation, while looking at how systemic state practices play out in times of crisis, and in the context of a neoliberal economy.

To do so, we identified and investigated three processes that influence how rents are determined: spatial attributes, real estate pricing, and local governance. To investigate how spatiality influences rent, we opted to survey rent prices along sections across the city instead of neighborhood clusters. This allows for a better correlation between physical/ social boundaries and rent prices. The survey included three cross sectional surveys of rent prices analyzed against conditions pertaining to the housing unit, the building and the surrounding environment. We developed a rent indicator tool that allowed for comparison of affordability vs. overpricing, which linked rent prices to physical housing conditions and characteristics, but also to symbolic geographic factors.

To determine the sections that would represent the rent ranges in Beirut, we produced a map that located principal sites in different neighborhoods that have gained symbolic meaning marking the city. This map includes high-rise towers, renovated heritage buildings, informal clusters and camps, malls, gentrified and popular commercial streets, parks, and major facilities, such as hospitals and universities.

On another level, we wanted to understand how real estate companies and brokers influence real estate market prices. For that, we interviewed several realtors, as well as collected and analyzed published online listings of rental housing supply.

In parallel to market processes, it was significant to look at the vital role of municipalities in managing the built environment, constructing physical and social boundaries, and inflating rent prices - instead of regulating adequate housing provision, building social cohesion and ensuring affordability. We also wanted to compare the practices of Beirut’s Municipality to neighboring municipalities such as Ghobeiri, Furn el Chebbak and Bourj Hammoud. We interviewed municipality representatives, as well as looked at land price valuation in administrative charts, resident tax, rent contract registration practices and tax, the process of registering vacancy and related tax exemptions.

Taking Beirut as a case study, we argue that interrelated factors of local governance, socio-spatial elements, and real estate interests shape rent prices in the main Lebanese cities. In doing so, we challenge the widely held perceptions that shelter acquisition in Beirut today is merely dictated by sky-rocketing land prices. Alternatively, we illustrate that a number of social, spatial, historical, symbolic and regulatory factors shape where city dwellers live and how.

2. Land as real estate: Practices of the State, Municipality, and Brokers

Lebanon’s rent legislations underwent a series of floundering rent laws. Today there are two main laws in force: the old rental law that governs extended contracts governed by rent control laws effective before 1992, and the rental law under the general civil code of obligations and contracts enforced on rental contracts after liberalizing contracts from rent control post 1992. Whereas the old rent law protects dwellers from sudden rent increases and prohibits evictions, the new rent law stipulates that the duration of the contractual agreement is limited to 3 years, after which the landlord is allowed to evict, raise rents unconditionally, change the use of the unit or simply keep it empty.

Liberalizing rent post 1992 indicates and emphasizes the legislative intent towards liberalizing rent from all kinds of regulation or control, clearly handing rental contracts to free economic impact and the sanctity of individual ownership1. Concurrently, land that includes buildings with old tenants became a target for real estate companies since the early nineties. This is when land prices began to escalate, putting them at odds with devalued rents, following the 1984 currency devaluation which marked the first steepest lira collapse, prior to the ongoing collapse we are currently witnessing.

The Free economic system’s sanctity of ownership is displayed through a series of tax and fees legislations. The law dated 17/9/1962 regarding “Taxes on Built Property” states in article 15 that taxes are suspended whenever the building is vacant and no revenues are received due to occupation. Furthermore, Art.3 states that the taxes are eliminated by the destruction of the building or building sections or due to sabotaging and the inability to benefit from them. This tax collection is implemented by the department of Ministry of Finance (MoF) in different governorates.

Another fee is stated by law on a municipality level by the virtue of law issued by a decree No. 60 dated 12/8/1988 on municipality fees and revenues. Art.3 of the mentioned law states that the occupants of the building are to be charged an annual fee on the rental value of the building or section of a building. This fee is collected based on the registration of the rental contract compelled on the owner in the municipality offices, whereas the obligation of rental fees payment falls upon the occupant by the virtue of this law. The occupant in this case can be the owner, the investor or the tenant. Again, the vacancy of the building or building sections exempts the owner from any form of fees to be paid to the municipality.

The municipal rental value fee is 6,5% of the annual rent fee as stated in the rent contract. However, municipalities also have a benchmark to follow when they issue annual schedules to collect these fees. For this matter, there are two committees within the municipality: The first committee2 (stipulated in Article 77 of Law No. 60/88), determines the selling price per square meter3, whereas the second (stipulated in Article 8 of Law No. 60/88) is tasked with evaluating the rental value of residential and non-residential units. Although the second committee benefits from the first to determine the newest rent fees, it has a separate mechanism that takes into consideration the duration of the rent contract. Since land prices have been on the rise, so have been municipal fees for newly registered rents, especially when these follow an announced vacant apartment. The prevailing practice links rent values to bank interests. If a landowner gets 5% interest rate on their bank deposits, rents are expected to reach the same percentage of land value. According to this formula, the current collapse of the banking sector, leaves rents at less than 1% of land value.

The municipal tax for inhabited units and the MoF tax for property registration are the two main instances where the state is interested in determining land prices. “This is far from constituting a land policy, yet the way in which the collected fees are determined reveals a lot about how land prices are set. Indeed, what is flagrant in the context of Lebanon is the total absence of a land policy and a related governing body, such as a Ministry of Planning or a Ministry of Housing. In practice, this translates into uncurbed property speculation, land monopoly, high vacancy rates, and land use disassociated from the public good or the public interest.”

The MoF issues an assessment determining the value of land prices per sector based on the meter price of an apartment in a newly constructed building. Accordingly, it sends the list to the land registry department which will use it to calculate the registration fee. However, these assessments are constantly challenged in practice leading to changes that sustain prices at a high rate. One broker gave the following example:

“If an apartment was assessed by the MoF at 200,000$ and registered as such. Another apartment in the same building should have been registered at the same rate already declared by the MoF. However, the asking price of this second apartment happened to be 500,000$ and declared as such on the obtained housing loan. The difference is flagged at the land registry, which prompts them to investigate, and eventually lead to an increase in the value of the remaining apartments following a new assessment issued by the MoF, adopting the principle of comparison with the highest value in the same building.”

This reference keeps pushing land prices up, especially in neighborhoods with a booming construction activity, which has characterized almost every neighborhood in Beirut. The 2004 building law and the master plan of Beirut, un-revisited since 1954, alongside a practice of granting exceptions to building regulations - highly contribute to large scale constructions that alienate the existing built fabric and produce prohibitive residential units.

3. Realtors 'City View' Inflate Rent Prices

The trend to keep land prices on the rise for the interest of real estate companies and the banking sector is thus set by governing bodies and legal procedures. In the absence of a housing policy, this leads to a whole new reality for inhabiting the city. The municipalities’ building safety and housing adequacy regulations have been reduced to performing structural inspection when following up on building permits for buildings under construction, whereas the old urban fabric is left to decay. Moreover, a large number of rents are oral and unregistered, hiding rental arrangements that exacerbate vulnerabilities. Taking a brief look at the Central Administration of Statistics’ data on inflation and how it is reflected in the rental market between December 2014 and December 2021, we can clearly see that the lack of housing regulation and tenants protection signify that uncapped rent prices will (and already are) exacerbate conflict between city dwellers and property owners, increase evictions, drive up the rate of vacancy and decrease the quality of housing.

When turning this data into a graph, we realized that the rent price index witnessed steady and small increases, while the general consumer index was almost constant for 2 years, with only a slight decrease. This increase in the rent index going in the opposite direction of the general economic atmosphere can be attributed to the influx of Syrian middle class refugees, which contributed to maintaining high demand over certain types of rental housing, as well as real estate investments4. The dynamics started to shift in December 2016, as a result of the general price index starting a steady uptrend and the rent price index almost plateauing for the next 3 years. As of 2016, when the central bank’s financial engineering expanded the money supply in lira, general price inflation constantly outpaced the inflation in rent prices.

The dynamics of the crisis appear in 2019, following the large-scale political upheaval, the strict bank restrictions on deposits, and the drainage of dollars from markets. The rift between the 2 indices takes the largest leap, and while the general inflation rises 125.39% ( from 116.17 to 261.83 points), the rent index lags behind at 143.6 points with only a 27.74% increase from the previous year. For the following months and until May of 2021, the rent index continues on a steady plateau as the general inflation index continues in a pattern of jittery sharp increases.

The first conclusion we can draw from this graph is that the economic crisis has not yet laid its full weight onto the housing market. The second is that if or when it does, the results would be catastrophic. A third conclusion is that the inflation of the prices of products and services related to housing, such as private generator fees, internet subscription, and water, implied by the increase in the general inflation index, signify a general increase in housing costs, even if rent price itself did not record an increase.

Amidst this reality, how are rents determined? One angle of investigation is the practice of brokers in the rental market. During February and March 2021 we surveyed entries listed publicly on the websites of brokers. In total, we collected 252 entries from 8 websites. 70% of surveyed listings were located in Achrafieh, followed by recurring listings for Badaro and Hamra, with only 4% of the listings each. The remaining 22% of the listings were distributed over 29 different neighborhoods, the majority of which had only 1 listing per area (see Map below). 65% of the entries were big apartments with 3 bedrooms or more, and the average price of all listings, regardless of size, was 1875$ per month.

In the graph above, we trace average prices of rent by area on brokers’ websites, overlaying it with the average purchase asking price per square meter for newly constructed apartments (on 1st floor), according to the latest data published by RAMCO in 2015 on real estate prices. The purpose of the graph is to look at the correlation between real estate prices and rent prices set on the broker’s listings. It is noticeable that there is a positive correlation between rents and real estate value, but it’s far from one-to-one. Neighborhoods exhibiting all levels of real-estate value offer fairly similar rents, except for three outliers that exhibit the highest rent per month in the data set. These outliers show higher correlation between rents and real-estate value, and removing them from the data set all but removes any correlation between rents and real-estate value.

In the table below, we divide the different areas listed on brokers’ websites into 3 categories according to their real estate prices: 25% least expensive, 50% middle priced, and 25% most expensive. This data is then overlaid with the realtors rent prices, similarly categorized and color-coded yellow for cheapest 25%, orange for middle 50% and red for 25% most expensive.

The reading of the table tells us that the cheapest real estate areas accommodate a wider range of rent prices, whereas the most expensive real estate areas maintain only the highest rent prices. Also, the cheapest real estate prices could still accommodate for the most expensive rent prices in the city.

Although this table shows that higher real estate value might contribute to generally higher rent averages, it also seems that lower real-estate values are not sufficient to devalue rent averages. Therefore, we must ask what other factors contribute to determining rent prices in Beirut's different areas, and to what extent do each of those factors influence the price?

4. Reading Rent through Spatial and Symbolic Factors

The previous section begins to challenge the clear rental map that is mostly delineated by price boundaries. In this section, we take this further by showing that shelter acquisition in Beirut is not only dedicated by sky-rocketing land prices, but by a number of social, spatial, historical, symbolic and regulatory factors that together shape where do city dwellers choose to live and how. In fact, Beirut’s historical growth - going from 300,000 inhabitants in 1950 to some 1.2 million inhabitants in 19755 - also coincides with the establishment of modern planning agencies, and the adoption of urban and building regulations that had a major effect in transforming the city, not only in its regulatory framework, but through determining who can live in the city and in what form.

In this part of the report, we look at these factors and validate them through fieldwork surveys conducted along lines cutting through several neighborhoods in Beirut.

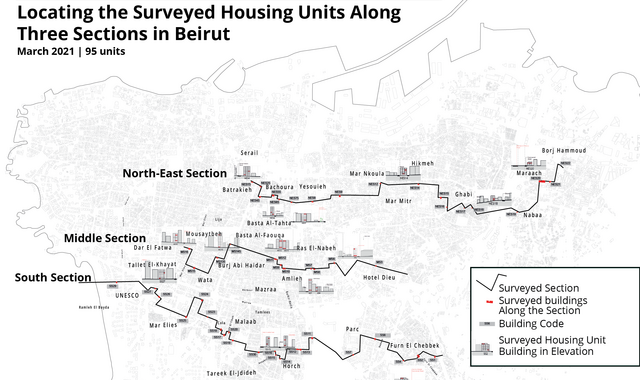

Our survey covered 95 units within 52 buildings along 3 general section lines crossing Beirut on an East-West access. The sections are chosen in a way as to cross known spatial physical (main roads axes and highways, Beirut river, municipal boundaries, Horch) and symbolic boundaries (sectarian, communitarian, economic and social class) both between Beirut and its direct suburbs, and within Beirut itself6.

Along these sections, buildings to survey were chosen based on their possession (or absence) of certain attributes, namely bordering an open space, in the vicinity of a landmark highrise, high security area, around a cultural landmark, within or near a stereotypically high class area, and within or near a popular or informal area. The fieldworkers surveyed 2 units within those chosen buildings, one to be located in the lower floors, and another among the upper most floors.

The majority of the surveyed units were 2-bedroom units (42%), followed by about 30% of 3-bedroom units, and 25% of 1-bedroom units, whereas units with 4 or more bedrooms didn’t constitute more than 3,2% of the sample.

The analysis of the rent amounts, charged per month by the landlords within the sample described above, showed that a rent range from 600,000LL to 900,000LL is the most common (27% of the rent amounts paid within the sample), followed closely by a rent range from 900,000LL to 1,200,000LL per month (26%). Only 13% of the rent amounts within the sample range between 300,000LL and 600,000LL per month, while the rest of the amounts were divided between 15% within the range of 1,200,000 LL and 2,100,000 LL, while 18% exceeded the value of 2,100,000LL, and one of them even reached up to the equivalent of 33,000,000LL per month.

The average rental amounts from our survey were visualized on a map. By overlaying them with real estate prices given by realtors, we can immediately conclude that there is a discrepancy. While, for example, Karm El Zeitoun and its immediate vicinity is considered by Ramco to be one of the areas with the cheapest real estate prices in Beirut, the rental price associated with one of the surveyed units on Ghabi Street showed to be considerably high. On the other hand, some units in UNESCO or Mar Nicolas, areas where real estate prices are considered high, show medium rental prices.

These findings also raise questions about the current rental housing affordability in Beirut, at a time when the statutory minimum wage still stands at 675,000LL per month as determined by decree 7426/2012. In fact, the results of comparing the rent amounts, paid by month within the sample, to this minimum wage, showed that nearly 75% of the rent amounts exceed the minimum wage, with some reaching twice to thrice the wage, and about 7% exceeding it by 10 times. “Individuals earning minimum wage cannot even afford to rent an apartment within the sample without spending more than 44 -50% of their income on rent.” In addition, tenants spend even more on basic services such as electricity, water, gas, and Wi-Fi. As such, the rent and additional related costs are a burden contributing to the economic hardship and disenfranchisement of the low-income communities living within the sample, and could potentially be a source of housing insecurity, eviction, and / or homelessness.

Here, it is worth highlighting that only 65% of the cases within the sample had written lease agreements signed with the landlord, which leaves the tenants in about 35% of cases in a weaker position if they ever fall behind with rent payments.

Analyzing the Survey Results through the lens of a Rent Indicator

The broad range of rental prices found in our survey indicates that - besides real estate prices - other factors are instrumental in generating rental prices.

The survey readings were deduced through developing a ratio indicator that quantifies (and visualizes) the relationship between several attributes of a housing unit and its rental price. The purpose of this score was to enable us to compare rents across units with similar characteristics, and read them geographically. A score was given to each residential unit based on a combination of attributes it possesses or lacks within the following criteria: surroundings, available services in the building, and apartment conditions. The below chart describes in detail the scoring system. The results have been visualized on a map (see below).

When looking at the map, it is easy to spot the existence of inflated index-to-price ratios for some residential units, the majority of which are linked to residential units where rent amounts are being asked in US dollars, as a responsive reaction of the landlords to the currency devaluation and the lack of restrictions on the rental market7. Out of the 95 surveyed cases, 10 were requested to pay rent strictly in dollars. These cases make up around 11% of the surveyed cases.

This actually means that a new form of segregation within a neighborhood is emerging, dictated by the massive discrepancy between asking rent prices in dollars. This phenomenon is not new to Beirut. The city has been exhibiting severe forms of socio-spatial segregation during the past decades. Even though very few gated communities exist in Beirut, the segregation is best conceptualized as a layer, through which affluent residents expand their «gated activities» over the totality of the city, or many parts of it, rather than remaining within one isolated area, as Alaily-Mattar (2008) argues8. Such expansion is being facilitated by the construction of tall and luxurious buildings in some neighborhoods within the city, while making use of «exceptions». «Exceptionality» was first introduced in the 1971 Lebanese building law, and allowed certain plots to gain a margin of flexibility in the implementation of urban regulations such as exceptional building heights and exploitation factors9. An invisible zoning dictated by these exceptions restructured the city10, and raised land value in ways that dramatically shifted property patterns. Ultimately, residential units in such «exceptional» buildings - in many of our survey cases overlooking major landmarks in the city, such as the seafront, Horch Beirut, and other public parks - are priced on the upper rent bracket.

However, some other medium to high ratios are not limited to units where rent is being paid in US dollars, and they are located in different geographic areas and neighborhoods, such as Wata, Dar al-Fatwa, Hotel Dieu, Ras Nabeh, Mar Nkoula, Hikmeh, al-Ghabi, Sin el-Fil, Yassouieh, Furn Chebbak, Horch, Parc, and others. So what are these high ratios attributed to?

First, we were able to analyze that many of these were overlooking highways or were adjacent to major roads. The highway grid that was gradually realized by the Lebanese government over the years played a crucial role in dividing Beirut's neighborhoods, and opening venues for real estate investments along those highways. In fact, it would be a mistake to assume that the «chaotic» growth of the Lebanese cities is the result of the absence of any regulations or planning interventions. On the contrary, planning the city has always been a major objective of the successive governments since the Independence (1943) and until the Civil War (1975-1991). Major European urban planners have made various urban proposals for Beirut, its suburbs, and other major cities11. Ecochard's plans are the most representative of the State's effort. They attempted to plan new infrastructure and to remodel city centers according to modern templates, with complete disregard to existing urban fabrics, social practices and local heritage.

A fourth attribute we analyzed is the existence of special development zones that widened the gap between the neighborhoods, and led to more segregation in the city. Historically, local engineers and architects12 were commissioned to implement specific urban projects, through what is known as a public land consolidation and resubdivision (مشروع ضم وفرز عام). These include areas such as Ramlet Al Baida (reaching UNESCO area), Badaro, and Mar Mitr. For example, the index-to-price ratio associated with a 4-bedroom unit in UNESCO area with a score of 11, is very much higher than the ratio associated with a 4-bedroom unit with the same score in Wata El Mousaitbeh. While tenants in UNESCO area pay 4166 US dollars per month as rent (equal to 33,328,000LL)13, tenants in Wata pay a monthly amount of 4,000,000LL. A similar discrepancy is found while comparing the index-to-price ratio associated with 2-bedroom units in Badaro and Malaab El Baladi area. The unit in Malaab, with a score of 10, is being rented at 750,000LL per month, while the unit in Badaro, with a lower score of 6, is being rented at 2,000,000LL per month.

Units in Karm El Zeitoun, Hay Maraach, Hay El Jdid, and Nabaa in Bourj Hammoud, presented the lowest index / score, all of which are informal neighborhoods or neighborhoods characterized by a level of informality. Such neighborhoods, which were historically populated due to rural-urban migration, the arrival of refugees from south Lebanon, from Armenia, and from Palestine, as well as migrant workers, today house low-income dwellers from all nationalities, while carrying the heavy burden of «misery belt» stigma, consequently making living near or around them quite undesirable. This is also true for Palestinian camps and their immediate vicinity. However, looking more closely at the characteristics of these surveyed units, they all lack building services, such as an elevator, concierge, parking, generator, etc. In fact, the rent price average calculated in total surveyed buildings with no services within the sample revolves around 703,556LL per month, while the rent price average in buildings with services revolves around 1,214,784LL per month (see graph below). The calculation of the averages excluded the units where rent is being asked in US dollars.

Additionally, the surveyed units in Karm El Zeitoun, Hay Maraach, Hay El Jdid, and Nabaa in Bourj Hammoud with the lowest index / score are all neglected, not maintained, or with bad physical conditions. In our overall sample, 21% of the units were in need of basic non-structural maintenance, 1 unit had severely bad basic services and in need of maintenance, and 77% of the units were reported in good condition. 2 units reported remaining damages from the Beirut port blast.

The rent price averages calculated for 1-bedroom units in the sample, showed that the average is considerably higher in buildings with good physical conditions (950,000LL per month) than in buildings with worst conditions (around 500,000LL per month).

Low price-to-index ratios were also found in surveyed units located in the neighborhoods of Zokak el Blatt, Furn El Chebbak, Wata El Mousaitbeh, and Tareek Jdeede. Looking at 10 units with the lowest ratio among them, we see that they are within relatively well-maintained buildings, have the required services, and are near basic amenities. Yet it is worth highlighting that their low index does not necessarily mean they are affordable. In fact, 9 out of 10 are 1-bedroom apartments with an average rent value of 600,000 per month - exceeding the minimum wage.

Another level of analysis is the role city boundaries (illustrated in the below charts) play in dictating rental prices. In comparing 2 cases from Karm El Zeitoun, a popular informal housing area within Beirut’s administrative border, with 2 cases from the neighboring area across the river, Hay Maraach and Hay El Jdid in Nabaa – Bourj Hammoud, sharing the same characteristics as Karm El Zeitoun, a significant inflation in the index-to-price ratio is seen in Karm El Zeitoun. For a 1-bedroom unit in Karm El Zeitoun, the ratio was found to be equal to 7.5, in comparison to a ratio of 1.525 for a 1-bedroom unit in Marash and Hay El jdid. This is also true when comparing the ratios of 2-bedroom units.

A similar cross-administrative-boundary analysis between Badaro and Furn El Chebbak for 2-bedroom units yields similar results; the unit in Badaro falling within administrative Beirut holds a significantly higher index-to-price ratio.

5. Generating Insecurity

Studies about housing issues in Lebanon have pointed to several reasons behind the shortfall in adequate housing, specifically the lack of a housing policy framework, the reliance on land to attract foreign capital and serve as safe assets for capital, the state’s perception of planning tools as instrument for financial investments, and subsequently the heavy penetration of private interests in the organization of the sector. These challenges affect city dwellers in each of the Lebanese cities. Vulnerabilities are nonetheless compounded for social groups that suffer from additional forms of discrimination.

This study tried to take stock of the rental housing situation and the ways in which prices are playing out in the context of the crisis. Indeed, since October 2019 and after many lost part or all of their incomes, and economic activities were disrupted or forcibly stopped by consequent lockdown decisions, causes of conflict grew between many tenants and property owners regarding rental contracts14. At times, landlords sought to mitigate the crisis by imposing illegal measures upon tenants, such as pressuring for increases in rent value, as seen in the 17 rent increase cases in our survey, or the valuation of rent prices to the dollar’s black market rate that brokers had adopted. In fact, data gathered from Public Works’ Housing Monitor received through its hotline between September 2020 and mid-March 2021 shows that 70% of the cases which have reported a rent increase or were asked to pay their rent sum in dollars, were under an imminent threat of eviction or have already been evicted.

70% of the cases which have reported a rent increase or were asked to pay their rent sum in dollars, were under an imminent threat of eviction or have already been evicted.

Those measures, along with the inaccessibility of formal mechanisms of justice to the marginalized communities, means that members of these communities (migrant workers, refugees, and LGBTQ+ individuals) find themselves unable to defend themselves against the landlords’ arbitrary practices. Between April and July of 2020, a period during which a heavy lockdown was imposed on the country, the Housing Monitor collaborated with the Anti-Racism Movement to document and assist in cases of eviction threats to migrant workers. All 243 cases of migrant workers had reported their inability to pay rent, but at the time, only 6 cases reported a demand by the landlord to increase rent15.

Following the Beirut port explosion, these existing tenure insecurities have been further exacerbated within the communities living in the affected areas. The Housing Monitor followed up on 127 reports from the blast-affected neighborhoods between September 2020 and June 2021, reports in which more than 474 individuals, including 176 children, 18 elderly people, and 8 people with disabilities were threatened. 58% of the reported cases were migrants and refugees of different nationalities, and the rest of the reports were Lebanese.

Karantina, being one of the closest districts to the port, and also housing a large Syrian refugee community, recorded the largest share of reports (32% of the overall reports), specifically from within its al-Khodr neighborhood where the percentage of reports from Syrian refugees reached 50%. Karantina was followed by Bourj Hammoud and Nabaa (24% of the reported cases), most of which were reported by migrant workers or refugee families, who accounted for 54% of the total reports received within these 2 areas.

The continued absence of state measures in the face of the blast, and its consequences on housing security left the ground open for new forms of vulnerabilities and exploitative housing conditions to emerge16.

The reports suggest that rent costs have become bigger burdens and that the inability to pay rent was the main reported cause of threat among the 127 cases, resulting in 38% of the total evictions carried out, with cases either having defaulted on their payments over the span of several months, or the landlord requesting unattainable rent prices or market rate dollar rent values.

These reports allowed us to inspect how the overlapping of vulnerabilities resulting from the absence of real protection of tenants rights all throughout- and even before the economic crisis, and the continued socio-economic disenfranchisement of a major component of city dwellers, has been reproducing and manufacturing forms of housing insecurity and systemized exploitation.

6. Conclusion

The lack of housing regulations and tenants protection signify that uncapped rent prices are exacerbating conflict between city dwellers and property owners, while increasing evictions, driving up the rate of vacancy and further deteriorating the quality of housing. With the added layer of a steep currency devaluation and the freefall of the economy, the study offers a reading of rental practices that further produce segregation.

We identified and investigated three processes that influence how rents are determined: real estate pricing, local governance, as well as socio-spatial attributes. Namely, we highlight the effects of exceptional urban planning practices, the construction of highways, special zoning, informality, landmarks and administrative city boundaries - on rental values. In doing so, we challenge the clear rental map that is mostly delineated by real estate area-based price boundaries, and show that shelter acquisition in Beirut is not only dedicated by sky-rocketing land prices, but by a number of social, spatial, historical, symbolic and regulatory factors that together shape where can city dwellers live and how.

While a free-market process in itself produces enough variance in rental prices to jeopardize the universal right to housing guaranteed in the human rights charter, policy-making that is unaccountable to a healthy democratic process and which works at the service of financial capital produces violent precariousness in housing and severe hardship in society at large.

Whether the economic crisis reaches the housing market full on is determined by a political decision, and consequently the deterrence of the catastrophic impact on housing rights is not impossible.

- 1. The sanctity of private individual ownership stems down from the Lebanese constitution. Alongside protecting individual ownership, it is certain that the constitution protects the right to housing. The preamble of the constitution adopted the universal declaration of Human Rights, the International Convention of Civil and Political Rights and International Convention on Economic, Social and Cultural Rights of 1966.

- 2. The land assessment committee (provided in Article 77 of Law No. 60/88), determines the price per square meter, and consists of: a municipal employee, an employee of the municipal union, an elected member of the municipality, an employee of the Ministry of Finance, a member in the Ministry of the Interior.

- 3. The selling price per square meter is that of the newest building following the classification of cadastral areas (linked to the date of issuance according to the increase in selling prices). The entire building is subject to the same guesswork, one that has nothing to do with the number of floors or the characteristics of the unit.

- 4. Ashkar, Hisham. « Benefiting from a Crisis: Lebanese Upscale Real-Estate Industry and the War in Syria », Confluences Méditerranée, vol. 92, no. 1, 2015, pp. 89-100.

- 5. Around half of Lebanon’s population at the time. Source: Bourgey, A., 1985, « La Guerre et ses Conséquences Géographiques au Liban », Annales de Géographie, XCIVe année, N. 521, Janvier-Février.

- 6. The Southern Section crosses from Furn El Chebbak to Ramleh El Bayda passing through areas such as Badaro, Horsh Beirut, Tarik Jdideh, Cola, Wata EL Musaytbeh, and UNESCO. The Middle Section does not extend beyond Beirut, but between Syoufi and Mar Elies, passing through Ras EL Nabeh,Basta, and Noueiri. The North-East Section extends between Burj Hammoud and Zokak-El blat, passing through Maraach and Hay El Jdid, Karm El Zaytoun, Mar Mitr and Hekmeh, Furn El Hayek, Bchara El Khoury, and Bachoura.

- 7. Out of the 95 surveyed cases, 17 reported changes in rent value over the previous year: 7 of which paid an increase in Lebanese Lira, and 10 were requested to pay rent strictly in US dollars. These cases make up around 20% of the total surveyed cases.

- 8. Nadia Alaily-Mattar, Segregation for aggregation? The pattern and logic of spatial segregation practices of young affluent heads of households in the post-war city of Beirut, October 2010

- 9. Where is Law? Investigations from Beirut1 Working Paper, Abir Saksouk (Public Works Studio)

- 10. Exceptions and the actually existing practice of planning: Beirut (Lebanon) as case study.

- 11. PLANS FOR AN UNPLANNED CITY: Beirut (1950-2000)

- 12. Like Farid Trad, Joseph Najjar, Gabriel Char, Mohamad Fawaz, Amine Bizri, Assem Salam, Henri Eddé, Pierre al-Khoury, or consulting firms like Dar al-Handasah.

- 13. calculated to 8,000LL as analysis took place in March 2021.

- 14. Reference: https://english.legal-agenda.com/leases-and-rent-payments-amidst-the-financial-and-coronavirus-crises-in-lebanon/

- 15. More details can be read in this report: https://housingmonitor.org/content/%D8%A8%D9%8A%D9%86-%D8%B3%D9%86%D8%AF%D8%A7%D9%86-%D8%A7%D9%84%D8%AD%D9%82-%D9%81%D9%8A-%D8%A7%D9%84%D8%B3%D9%83%D9%86-%D9%88%D9%85%D8%B7%D8%B1%D9%82%D8%A9-%D8%A7%D9%84%D8%A3%D8%B2%D9%85%D8%A9-%D8%A7%D9%84%D8%A7%D9%82%D8%AA%D8%B5%D8%A7%D8%AF%D9%8A%D8%A9-%D8%B4%D8%A8%D8%AD-%D8%A7%D9%84%D8%A5%D8%AE%D9%84%D8%A7%D8%A1-%D9%8A%D9%87%D8%AF%D9%91%D8%AF-%D8%A7%D9%84%D8%B9%D9%85%D8%A7%D9%84-%D8%A7%D9%84%D8%A3%D8%AC%D8%A7%D9%86%D8%A8

- 16. Those were either related to the blast damages or to the processes that followed and that involved NGO interventions for repairs and the partial distribution of compensation by the army. The evictions and threats came in the forms of rent increases upon renovations by NGOs, or pressures to confiscate the aid being sent to the tenants by external parties, or the landlord refusing or obstructing renovations, or attempting to terminate rent contracts and refusing to renew them.